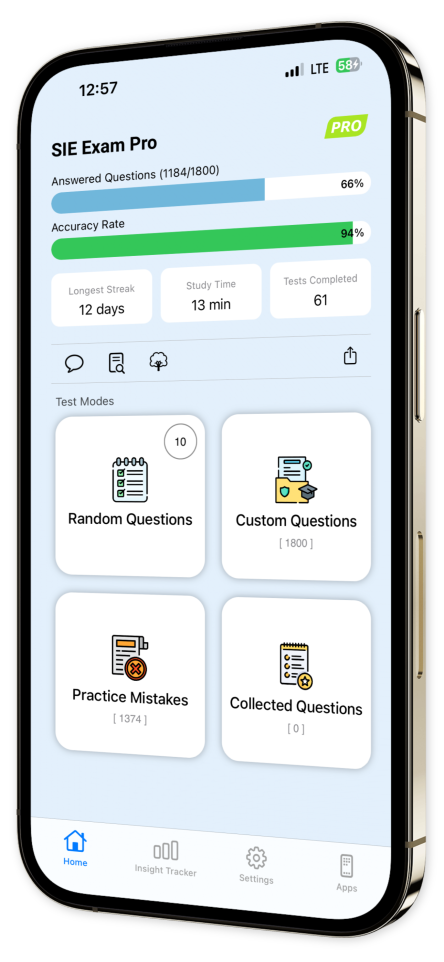

SIE Exam Pro iOS and Android App

Crush the SIE Exam and Launch Your Finance Career with SIE Exam Pro!

Prepare to excel in the FINRA Securities Industry Essentials (SIE) Exam with SIE Exam Pro — the go-to app for aspiring finance professionals eager to establish a strong foundation in the securities industry. Whether you're aiming to break into the world of finance, broaden your career options, or build the essential knowledge needed for future licensing exams, our app delivers the resources you need to succeed.

Immerse yourself in a comprehensive collection of exam-focused questions and thorough explanations, covering all critical aspects of the SIE exam, including market structures, types of products and their risks, regulatory agencies and their functions, and prohibited practices. With customizable quizzes, real-time progress tracking, and detailed feedback, you'll be able to identify your weak areas, enhance your understanding of key concepts, and approach the exam with the confidence to succeed.

Key Features:

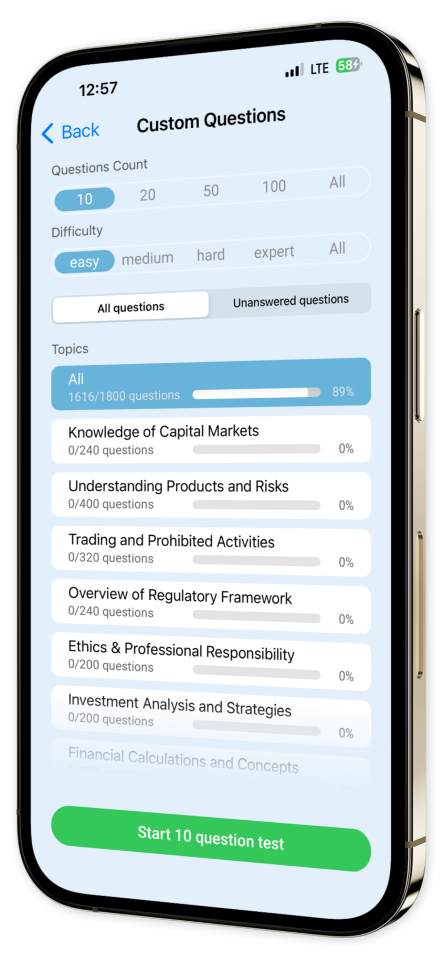

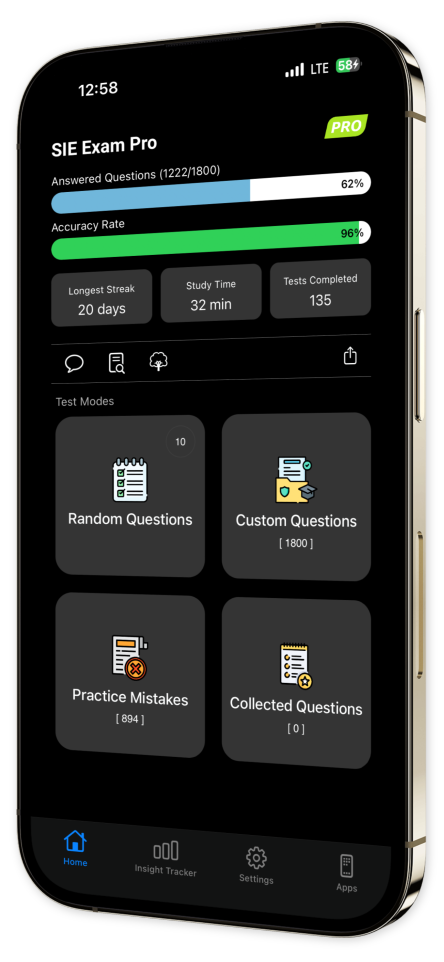

Extensive Question Bank: Access hundreds of practice questions designed to mimic the actual exam format.

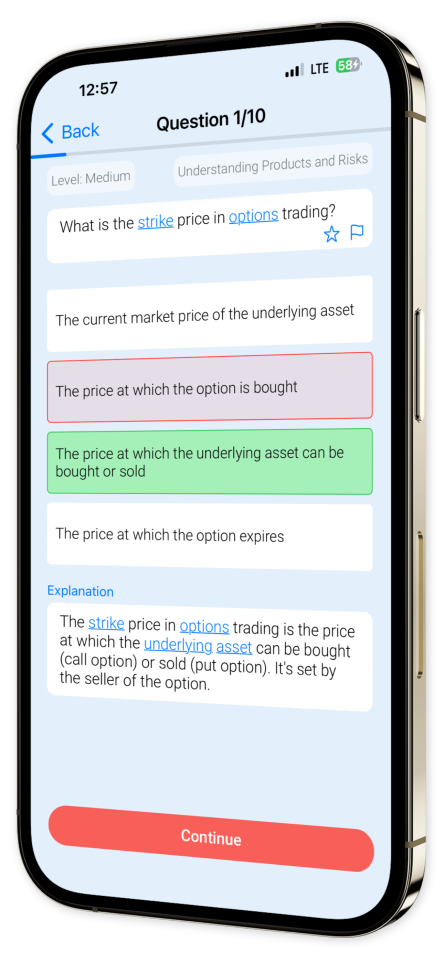

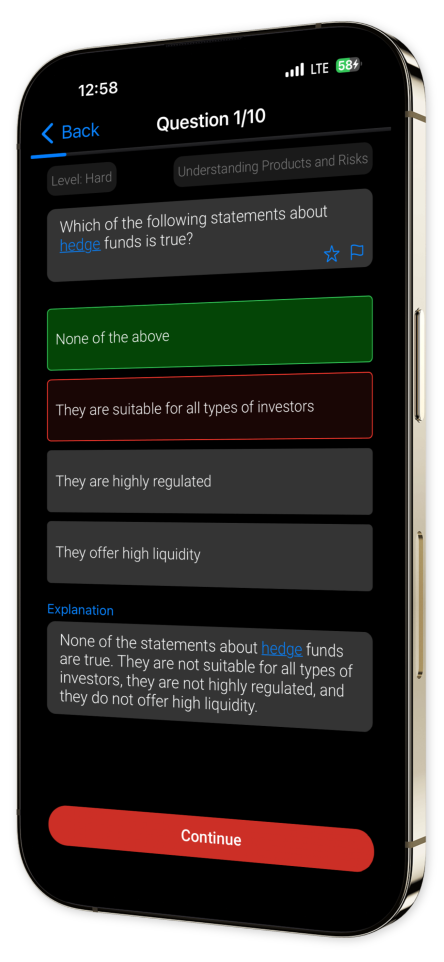

In-Depth Explanations: Learn the reasoning behind each answer to expand your securities industry knowledge.

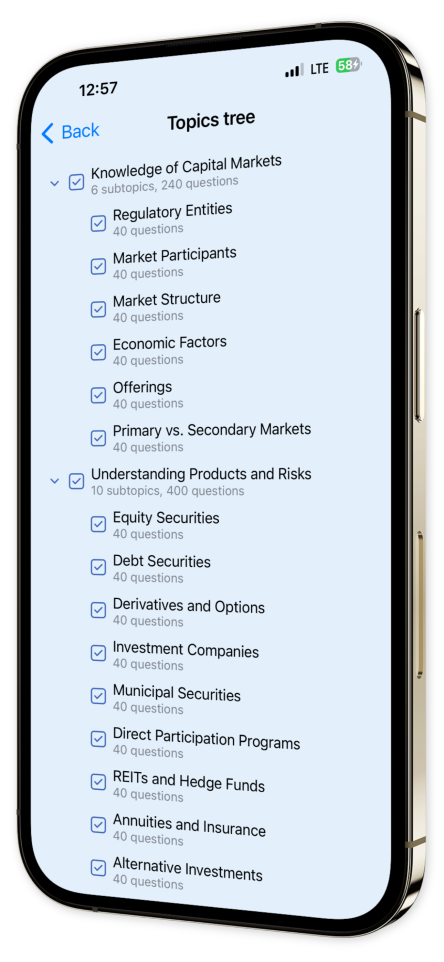

Customizable Quizzes: Focus your studies on specific topics to target areas for improvement.

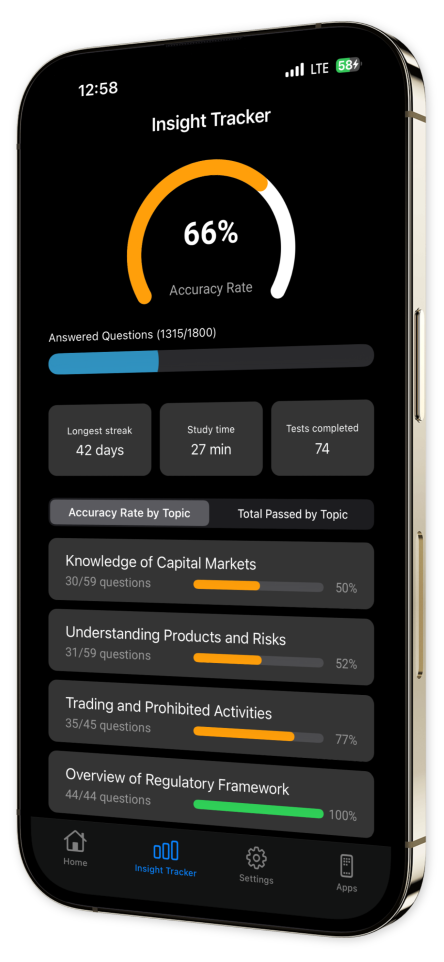

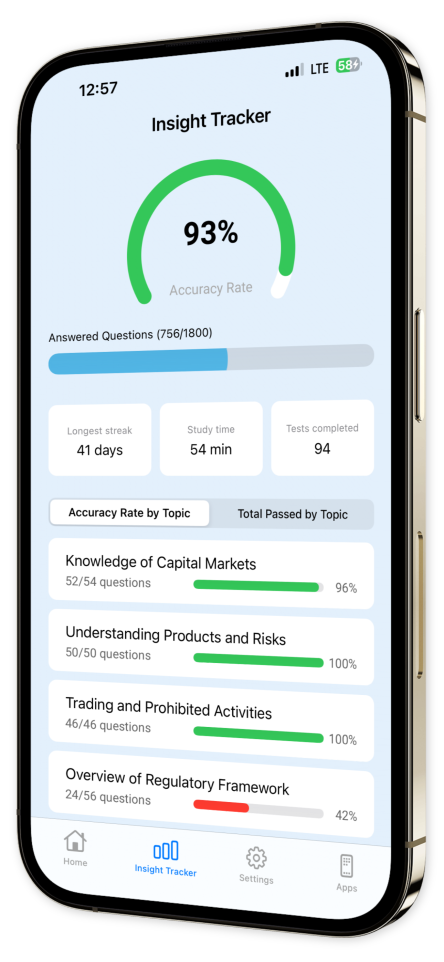

Performance Analytics: Track your progress and ensure you stay on course with your study plan.

Join the ranks of finance professionals who have successfully navigated the SIE exam using SIE Exam Pro. Build your market knowledge, open the door to new career opportunities, and start your journey in the securities industry on the right foot.

Don't leave your success to chance. Download SIE Exam Pro today and set the stage for a promising finance career!

Content Overview

Explore a variety of topics covered in the app.

Example questions

Let's look at some sample questions

What does it mean for an option to be 'out of the money'?

The option cannot be exercised profitablyThe option has expiredThe option has no intrinsic valueThe option can be exercised profitably

An option is 'out of the money' if it cannot be exercised profitably. For a call option, this means the current market price of the underlying asset is below the strike price. For a put option, it's when the current market price is above the strike price.

What type of REIT primarily loans money to real estate owners or invests in existing mortgages?

Equity REITMortgage REITHybrid REITNone of the above

Mortgage REITs primarily loan money to real estate owners or invest in existing mortgages. They generate income from the interest on these loans.

Which risk refers to the possibility that investments will not be able to keep pace with inflation?

Inflation RiskInterest Rate RiskLiquidity RiskBusiness Risk

Inflation risk, also called 'purchasing power risk', is the chance that the cash flows from an investment won't be worth as much in the future because of changes in purchasing power due to inflation.

Which order type can potentially not be executed?

Limit OrderStop OrderStop Limit OrderMarket Order

A stop limit order may not be executed if the security's price never reaches the stop limit price.

What is a corporate account?

An account owned by an individualAn account owned by two or more personsAn account owned by a minorAn account owned by a corporation

A corporate account is an account that is owned by a corporation. The other alternatives do not correctly define a corporate account.

What happens after a Hearing Panel issues its decision in a disciplinary action?

The decision is finalThe decision can be appealed to the SECThe decision can be appealed to the National Adjudicatory CouncilThe decision can be appealed to the Supreme Court

After a Hearing Panel issues its decision, it can be appealed to the National Adjudicatory Council.

In what situation would a financial advisor NOT have a conflict of interest?

When they receive a commission for selling a specific productWhen they recommend a product that they personally ownWhen they recommend a product solely based on its suitability for the clientWhen they execute trades that result in higher fees for them

A financial advisor would not have a conflict of interest when they recommend a product solely based on its suitability for the client. This demonstrates that they are prioritizing the client's needs and objectives over any potential personal or corporate gains.

What is the purpose of trend lines in technical analysis?

To identify the intrinsic value of a stockTo calculate the dividend yield of a stockTo identify the direction of a stock's price movementTo determine the book value of a stock

Trend lines are a simple and widely used technical analysis approach to judging entry and exit investment timing. To establish a trend line historical data, typically presented in the format of a chart such as the above price chart, is required. Hence it is used to identify the direction of a stock's price movement.

What does dollar-cost averaging involve?

Investing a fixed dollar amount at regular intervalsInvesting all available funds at onceInvesting only when the market is highInvesting only in dollar-denominated assets

Dollar-cost averaging involves investing a fixed dollar amount at regular intervals, regardless of the price of the investment at that time.

What is the measure of a portfolio's excess return per unit of risk called?

AlphaBetaSharpe RatioTreynor Ratio

The Sharpe Ratio measures a portfolio's excess return per unit of risk.